Tontiners benefit financially just by staying healthy and living longer than average

The problem we set out to solve

Retirement can be stressful if you don't have a pension.

This is because a standard 401(k)/IRA can run out of money if you live 'too long'.

The reality of modern retirement is that:

- none of us know when we will meet our maker,

and - none of us want to spend our whole retirement worrying about spending our savings.

A 'tontine' is a 400 year old pension that ensures an income for life which is expected to rise over time to offset inflation.

What is a Tontine?

A tontine is a simple pension managed by fiduciaries where any saver can contribute money into a trust in return for a lifetime income.

Since the invention of the tontine in the 17th century, consumers have always preferred tontines to annuities.

This is because each saver without a pension faces the risk that they will live a long life and end up running out of money in old age.

In a tontine, the savers now share this risk with a community of other savers of the same sex and age.

The lifetime income is assured by the fact that when members of a tontine pass away earlier than expected, their account balances are inherited by the surviving members of that tontine, causing the survivors balances and monthly income to rise.

Typically, these redistributions continue until the second last member passes away after which all of the remaining capital is paid to the sole surviving member that was blessed with the longest life.

What's in it for me? How much income can I expect?

Our modern Tontines are designed to be so simple to understand that a regular saver can explain it just as well as their financial advisor.

When you join a Tontine, the income paid by the trustees is recalculated every month based upon interest rates, currently 5.32%, plus a portion of the capital roughly equal to the chance of someone dying at that age.

This combined %, which increases over time as each members risk of dying increases, is known as the safe withdrawal rate.

Every month the trustees recalculate your safe monthly withdrawal rates multiplied by your expected account balance to display the dollar amounts that you can expect to be paid each month for the rest of your life.

Secure a lifetime income that lasts as long as you do

So a TontineIRA™ is designed to provide a a steady monthly income for life but how can we be so sure that the income will never run out like in a regular IRA or 401k?

Well this is the natural simplicity of a Tontine Trust®.

Year by year, a predictable and rising percentage of the members of your tontine community will inevitably meet their maker leaving you to inherit a proportional share of the income that they no longer need.

As a result, the balance of your TontineIRA™ remains fairly steady over time even though you are drawing a generous income every month.

Tontines are a useful way to hedge against inflation

Inflation destroys the spending power of retirees that are on a fixed income. This ruins their ability to enjoy their retirement because they know that they will have less and less to spend as the years roll by.

This is where the Tontine effect comes in and perhaps explains why Tontines are historically five times more popular with consumers than fixed annuities.

In a Tontine, as the decades pass by, a greater percentage of the members of your assigned Tontine community will start passing away causing you to to inherit larger amounts every year as a kind of tribute from your fellow members for you having outlived them.

And because your payout rate is rising (see above) as well as your balance, you can expect your monthly income to start rising, particularly in later years.

Doesn't that sound like a better retirement to look forward to?

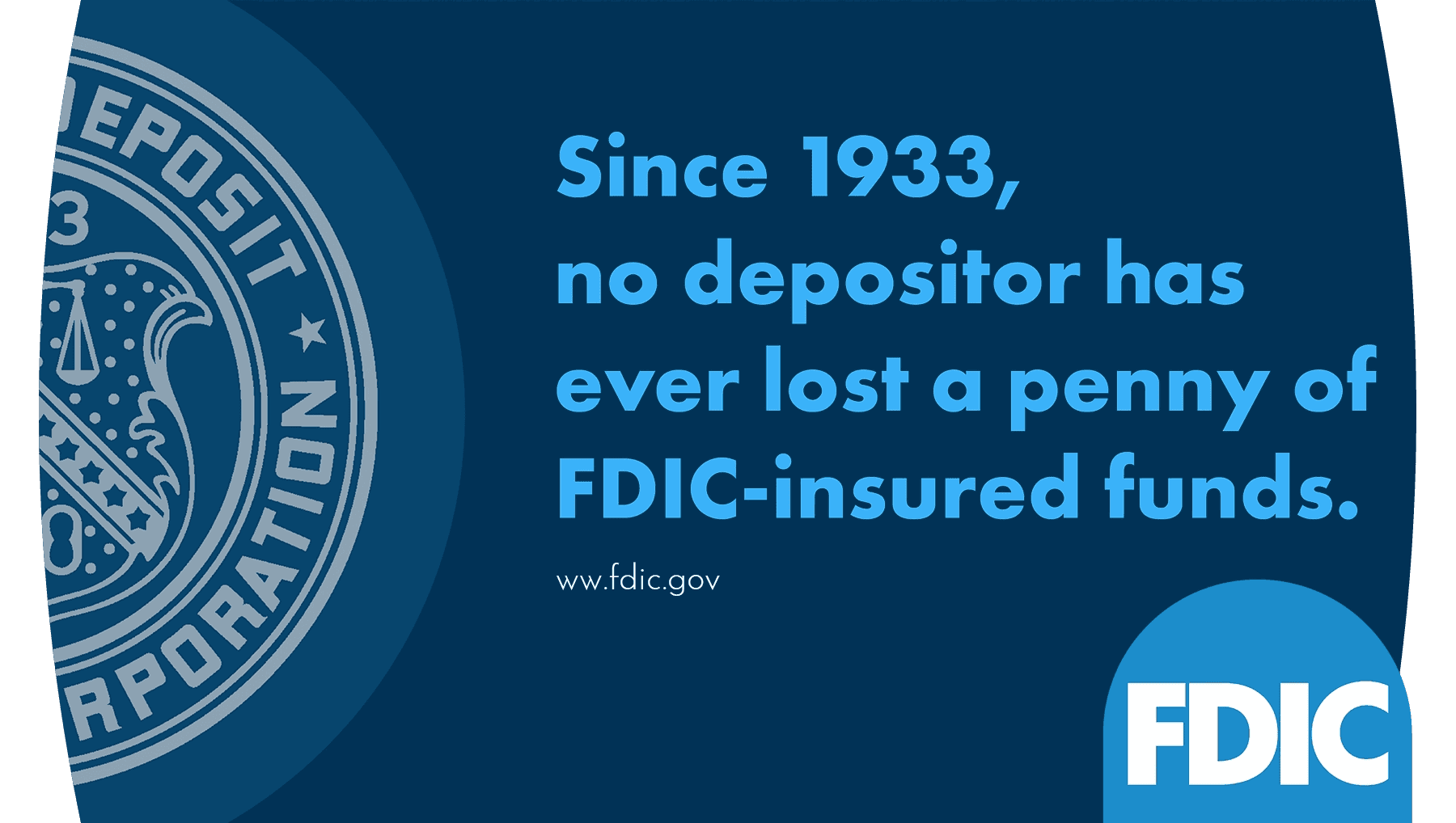

Safety first: Your savings are secured in FDIC insured CDs

Bank trustees & fiduciaries are typically highly conservative people by nature.

This is why they are increasingly wary of investing retirement monies into annuities which turn out to be backed by assets in the Bermuda triangle and why they are increasingly cautious about target date funds which as the AARP pointed out can occasionally get 'clobbered' by 20%.

For these reasons, in the current market environment, the TontineIRA™ trustees prefer to take the safer path by investing in CDs from multiple FDIC insured banks.

As a result, the assets in your account are guaranteed by the full faith and credit of the US federal government up to $10m per TontineIRA™ while still currently earning a generous ~5.32% interest per year.

Give your children an inheritance now instead of a headache later

If a parent lives into their 90s then most likely the children will be in their 70s when they receive any inheritance. Worse still is that if the parent runs out of money though then under US filial responsibility laws their children may be liable to pay the parents care bills.

With a regular 401(k) or IRA plan, passing on some of your savings to the kids while they are still young increases the risk of the plan running out of money in old age.

Lifetime incomes though, whether from a TontineIRA or an annuity, reduce these risks by ensuring that there will always be some level of income to support your living costs no matter what age you live to.

As an added bonus, once you secure a suitable level of lifetime income, you may now be able to afford to help the kids buy a house or start a business while they are still young.

Flexibility & Control

While we encourage everyone to save as much as possible for retirement, sometimes life just gets in the way.

This is why we have designed the TontineIRA™ to be as flexible as possible meaning that you can invest as much or as little as you want at any time.

Want to change or stop your contributions for a while? No problem, just enter the new amount in the app or press the Pause button.

Want to delay or bring forward when your monthly income starts? Just set the new date in the app and press Save. It's that simple.

Managed by Fiduciaries acting in your best interest

Your TontineIRA™ is managed by trustees acting in a fiduciary capacity which means that they are legally and ethically bound to act in your best interest.

This contrasts with other lifetime income solutions such as pure insurance products and securities which are typically sold by commission agents on a buyer-beware basis.

Such practices in respect of retirement savers are rightly coming under increasing scrutiny from the US Department of Labour.

Our unrivaled low fees preserve more income for you

We want to profit with our members not from them which is why we charge a flat low annual fee of 1% which includes all filing fees & charges.

This is also why we don't work with commission based agents which have become accustomed to receiving 3-8% of their client's retirement savings as a sales commission.

We are of course delighted to work with fee only advisors and fiduciaries.

Secured by a 'password' you'll never lose

In an era where everyone is increasingly worried about 'elder fraud', online security is becoming increasingly complex even for technically sophisticated users.

This is why we have developed a patented system which replaces hard-to-remember passwords with advanced facial recognition technology.

Now, whenever you need to take a sensitive action on your account such as approving a payout or changing your bank details, you can login to our app using your face so that we can be sure that it is you, and only you, that is controlling your account.

What the world says about us

Noah Balulis

Youtuber

youtube.comI have to agree that most people do worry and think about their retirement in fear. It would be lovely to see this change. The world could surely become a happier, more exciting place.

Jonathan Chevreau

Tontines are easier to administer, cleaner and less capital-intensive and can be expected to generate rising payment streams over time, at least for those who live long enough to benefit from the superior mortality credits they provide. In a classical tontine, payments are initially quite low – at best comparable to the risk-free rate on bonds... But as retirees die, tontines become more attractive for those who survive. The last few survivors may receive 10 times more than they put into the scheme.

Raoul Pal

I love the idea of Tontines. They solve so many problems for retirees. These guys are bringing them back, super interesting.

Olivia S. Mitchell

A tontine is an investment pool managed in an actuarially fair way, according to a plan for distributing fully-funded payouts to investors. There are two key differences between a tontine and an ordinary investment. First, tontine investments are generally irrevocable. Second, account balances are not transferred to a member’s beneficiaries upon death. Instead, remaining assets are equitably apportioned among the pool’s surviving participants. Accordingly, monies forfeited by those who die increase the returns to those who survive.

These extra returns are referred to as “mortality credits.” In this way, tontines allow members to collect lifetime income by collectively self-pooling longevity risk among themselves. This obviates the need for (and cost of) an insurer as guarantor. Tontines are not insurance, though they can deliver lifetime income similar to payout annuities and pensions. Tontines simply cut out the middleman.

Jason Sen

At 55, my biggest concern is the potential burden on my kids if I'm unable to work and an unexpected illness strikes. The Tontine-based pension product deals with this issue with a steady stream of funds for life to ensure the bills are always getting paid.

Gary S. Mettler

First rate! I'm so excited about your effort I can barely stand it!

Jason Maggard

This is brilliant. I'm 50 and was in retirement planning a number of years back. All retirees with any amount of money FEAR outliving their money. So they rarely enjoy spending in retirement without guilt. So they scrimp and die someday with 10%-80% of their money left over. How great to know each year you last in retirement your standard of living goes up! Spend Enjoy More Is Coming Next Month. Brilliant!

Save your spot for a test drive to see if a TontineIRA™ is right for you.